tax shelter real estate definition

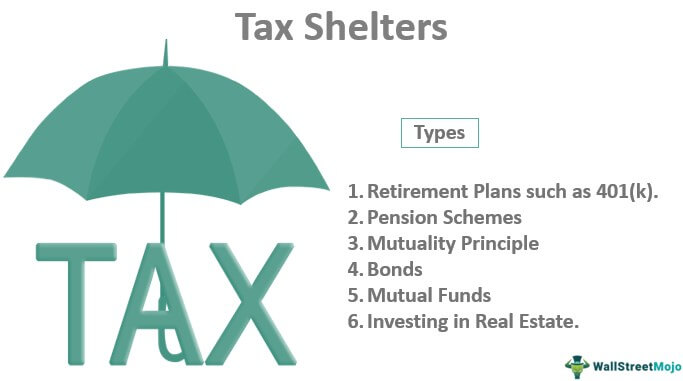

A taxpayer that is a tax shelter as defined in section 448d3 of the Internal Revenue Code is not permitted to use the cash method pursuant to section 448a3 and is also not permitted to use the small business taxpayer exemptions contained in sections 163j3 limitation on business interest 263Ai uniform capitalization 460e1B percentage of. Other tax shelters include mutual funds municipal bonds.

Taking Advantage Of Tax In Real Estate How Physician Investors Win Big

These are cash losses.

. Internal Revenue Code US. The term tax shelter means. One of the tax shelters is to invest in real estate but in reality each real estate is a separate entity on its own.

A tax shelter is advantageous by the taxpayers in high tax brackets so they can take losses from it to reduce their taxable income. To be a tax shelter the investment has to lose money. 461i3 provides that the term tax shelter.

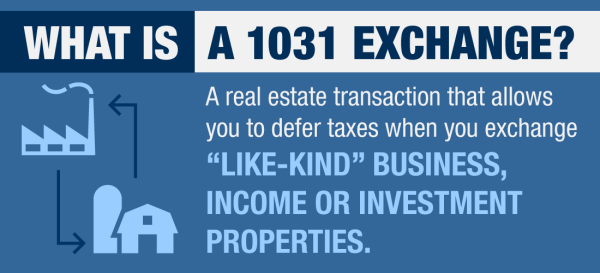

Located in eastern Loudoun County the Dulles area offers convenient access to the heart of DC the international airport and several sprawling parks. In 2022 employees can make up to 20500 in deductible contributions to a 401 k with workers age 50 and older entitled to deduct an additional 6500 in catch-up contributions. Shield Your Profits with a 1031 Exchange.

There is a penalty of 1 of the total amount invested for the failure to register a tax shelter. The Dulles Facilities Operations Manager will report directly to the Sr. Tax Shelter A general term used to include any property which gives the owner certain income tax advantages such as deductions for property taxes maintenance mortgage interest insurance and especially depreciation.

Personal Property Tax Rate. Tax shelters work by reducing your taxable income thereby reducing your taxes. Shelters range from employer-sponsored 401 k programs to overseas bank accounts.

Risk Free Pass Guarantee. Tax shelters are legal unless their sole purpose is to avoid taxes. Low online fee includes federal and state returns no matter what.

448a3 prohibition defines tax shelter at Sec. A tax shelter is a method used by businesses and individuals to reduce their tax liabilities. 7 Create an Incredible Tax Shelter by Investing in Rental Real Estate.

The IRS allows some tax shelters but. A number of real estate tax shelter exist. A tax shelter is a vehicle to reduce current tax liability by offsetting income from one source with losses from another source.

Aside from the attempts to stop tax shelters in the United States through provisions of the US. An investment vehicle that reduces ones tax liabilityFor example a 401k defers taxation until withdrawal from the account and may therefore be considered a tax shelter. Best Value on the Market.

A vehicle has situs for taxation in the county or if it is registered to a county address with the Virginia Department of Motor Vehicles. Tax shelters have therefore often shared an unsavory association with fraud. Most business owners depth of understanding of a tax shelter is that it has something to do with the avoidance or evasion of tax which makes sense.

The ready to use real estate property has two phases under construction and the other one is the developed phase. 25 to file your taxes. A tax shelter is a method for reducing taxable income by investing in certain protected asset categories.

Allowable Rental Property Tax Shelter Deductions. Review these nine legal tax shelters that can save you a bundle because everyone wants to reduce their taxable income and save money by taking every deduction they can. Personal property taxes are due May 5 and October 5.

Updated for 2020 Regulations. Dulles Homes Real Estate. Tax Shelter Law and Legal Definition.

5 Additional Morris Invest Articles. The judicial doctrines have a basic theme. Tax shelters are ways individuals and corporations reduce their tax liability.

Any enterprise other than a C-Corporation if at any time interest in such enterprise have been offered for sale in any offering required to be register with any Federal or State Agency has the authority to regulate the offering of securities for sale 2. TSSD Operations and Strategy Manager. 448d3 which states that the term tax shelter has the meaning given such term by section 461i3 Sec.

A tax shelter is defined differently under various Code sections with one of the broadest definitions used in this case. In other words you are having to put money into the investment to keep it floating. The assessment on these vehicles is determined by the Commissioner of the Revenue.

Here we discuss the types of tax shelters. Courts have several ways to prevent tax sheltering activities from happening. For more information about Dulles properties for sale including previous pricing history.

There are legal and illegal tax shelters. The most common tax shelter is through such retirement accounts as a 401 k 401 b Roth IRA or a Roth 401 k. When it comes to rentals it is easy to lose money especially if the rental income does not cover the mortgage you have several repair bills among other things.

90-Day Access to Our Testing Materials. Northrop Grumman is currently seeking an experienced Facilities Operations Manager 1 to join our Tactical Space Systems unit team in our Dulles Campus. The goal of a tax shelter is to create economic value with an investment by using the incentive of a lower tax liability.

The failure to report a tax shelter identification number has a penalty of. Traditional tax shelters have included investments in real estate oil and gas equipment leasing and cattle feeding and breeding programs. Someone who thinks a feature of the tax code giving.

This has been a guide to what is Tax Shelters and its Definition. Illegal tax shelters include many offshore bank accounts used to avoid. 6 Resources for Jump-Starting Your Wealth Building.

250 Sample Real Estate Exam Questions. The phrase tax shelter is often used as a pejorative term but a tax shelter can be a legal way to reduce tax liabilities. The selected candidate will be responsible for managing all Facilities day-to-day.

Real Estate Tax Shelters Lower Taxes Through Depreciation. Search the newest homes for sale near Dulles International Airport in Dulles VA below. The definition of a tax shelter therefore becomes a critical factor in determining tax consequences for a business that otherwise could be a small business.

Capital Gains On Home Sales What Is Capital Gains Tax On Real Estate Guaranteed Rate

Tax Shelter Definition Examples Using Deductions

Tax Shelters For High W 2 Income Every Doctor Must Read This

What Is A Credit Shelter Trust Our Deer Estate Law Estate Planning Estate Tax

What Is A Tax Shelter And How Does It Work

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Are You Eligible For A 1031 Exchange

The Sales Proceeds Calculation Home Mortgage Rental Property Real Estate Investing

Understanding Real Estate Assessments Tax Administration

How To Become A Real Estate Professional For Tax Purposes Mark J Kohler

Using Your Real Estate Investments As A Tax Shelter

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Tax Shelters Definition Types Examples Of Tax Shelter

Section 721 Exchange Defer Capital Gains Taxes While Increasing Diversification In Real Estate Engineered Tax Services

The Top Tax Court Cases Of 2018 Who Qualifies As A Real Estate Professional

How Physicians Can Reduce Tax Bill By Using Cost Segregation And Bonus Depreciation